RECAPTURE OF DEPRECIATION

Depreciation Recapture: Understanding its Relevance in Real Estate

Unveiling Depreciation Recapture

In the realm of real estate, the concept of depreciation recapture holds significant relevance, particularly concerning the taxation of property assets. Depreciation recapture refers to the reclamation of previously deducted depreciation expenses upon the sale or disposition of a property, resulting in potential tax liabilities for property owners.

Implications for Real Estate Investors

For real estate investors, the prospect of depreciation recapture necessitates careful consideration, as it directly influences the tax implications associated with property transactions. The recapture of depreciation can impact the capital gains realized from the sale of a property, potentially leading to increased tax obligations for property owners.

Navigating Taxation and Asset Management

Understanding the intricacies of depreciation recapture is paramount for real estate investors and property owners, as it directly influences financial planning, investment strategies, and asset management. By comprehending the implications of depreciation recapture, individuals and businesses can make informed decisions regarding property acquisition, ownership duration, and divestment, thereby optimizing their tax positions and overall investment outcomes.

Conclusion

In conclusion, depreciation recapture stands as a critical consideration within the realm of real estate, exerting profound implications on the taxation of property assets. By recognizing the impact of depreciation recapture, investors and property owners can navigate the complexities of real estate taxation, bolstering their financial acumen and strategic decision-making. Embracing a thorough understanding of depreciation recapture empowers stakeholders to optimize their tax positions, enhance investment strategies, and effectively manage their real estate portfolios in alignment with their broader financial objectives.

MORE REAL ESTATE TERMS

A, B, C, D, E, F, G, H, I, J, K, L, M, N, O, P, Q, R, S, T, U, V, W, X, Y, Z

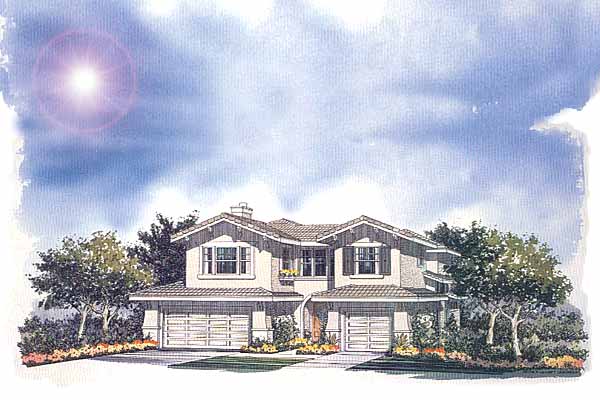

Featured New Home

Featured Mortgage Brokers

- BANK OF AMERICA NA CHARLOTTE, FOREST HILLS, NY

10510 QUEENS BLVD STE 2

FOREST HILLS, NY 11375 - FINANCIAL FREEDOM ACQUISITION LLC, IRVINE, CA

1 BANTING

IRVINE, CA 92618 - CHARTER WEST NATIONAL BANK, GRAND ISLAND, NE

714 N DIERS AVE

GRAND ISLAND, NE 68803 - American Finance-Thomasville, mortgage broker in Thomasville, GA

15179 US Hwy 19 South

Thomasville, GA 31792 - ACADEMY MORTGAGE CORPORATION, CHICO, CA

1600 MANGROVE AVE STE 100

CHICO, CA 95926